Can I Deposit a Personal Check to Myself?

In the realm of personal finance, one of the questions that frequently arises is whether one can deposit a personal check to oneself. This might seem like an unusual transaction, but there are legitimate reasons why someone might want to do this, such as moving funds between accounts owned at different banks. This blog will explore the concept of self-check deposits and how it fits into the broader context of personal checkings.

Understanding Personal Checkings

Before delving into the specifics of depositing a check to yourself, it’s important to have a clear understanding of how personal checkings work. A personal checking account is a bank account that individuals use for day-to-day transactions. It allows for deposits, withdrawals, and the writing of checks, among other features.

The Role of Checks in Personal Checkings

Checks are written orders to a bank to pay the specified amount of money from your personal checking account to another party. While digital payments are increasingly popular, checks remain a valuable tool for many, offering a straightforward method for transferring funds.

Can You Deposit a Personal Check to Yourself?

The simple answer is yes, you can deposit a personal check to yourself. This is a common practice for transferring money between your own accounts at different banks or financial institutions.

How to Deposit a Personal Check to Yourself

- Write the Check: Fill out the check as you normally would, writing your own name on the “Pay to the order of” line.

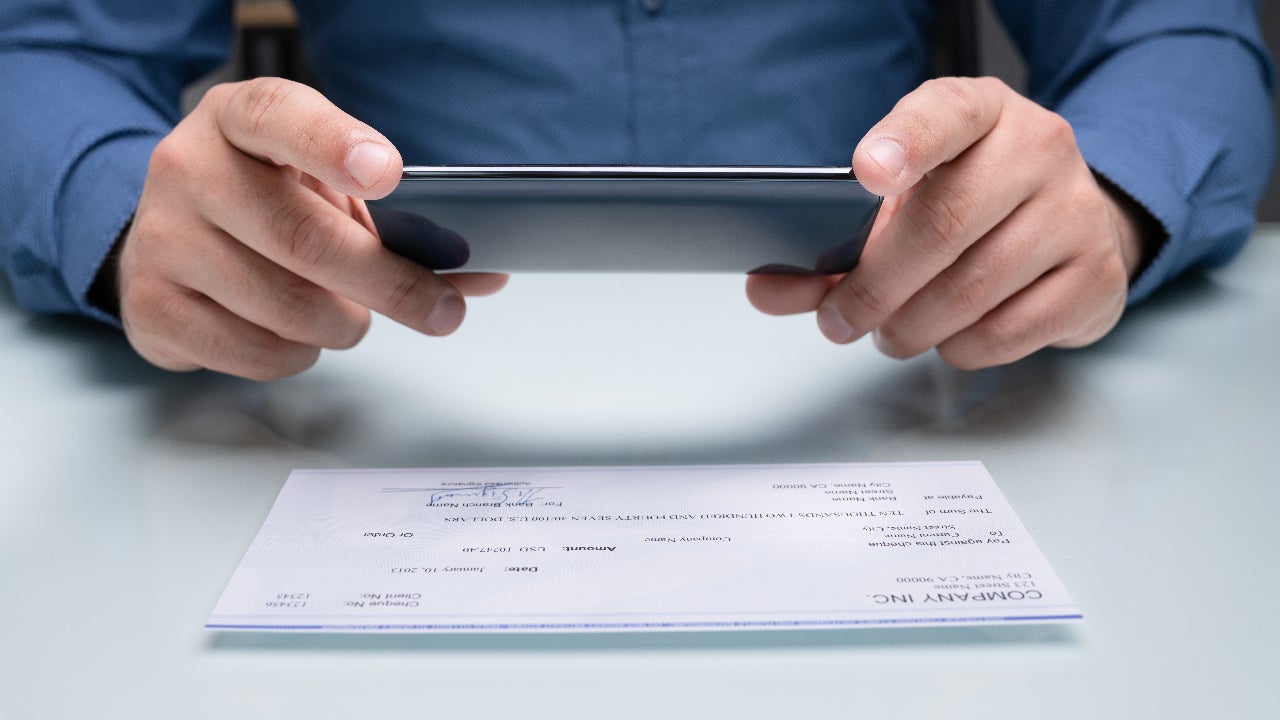

- Choose the Deposit Method: You can deposit the check into another account you own via mobile deposit, ATM, or in-person at a bank branch.

- Wait for the Check to Clear: Just like any other check deposit, there will be a short processing time before the funds are available in your account.

Reasons for Depositing a Personal Check to Yourself

There are several reasons why someone might choose to deposit a personal check to themselves, including:

- Transferring Funds Between Banks: If you have accounts at different banks, depositing a check to yourself can be an easy way to transfer funds.

- No Direct Transfer Option: Not all banks offer easy electronic transfers between different banks, so a personal check can be a good alternative.

- Record Keeping: Writing a check to yourself creates a paper trail that can be useful for personal record-keeping.

Considerations for Self-Check Deposits

While depositing a personal check to yourself is generally straightforward, there are a few things to keep in mind:

Potential Fees

Some banks may charge fees for certain types of deposits or for accounts that don’t meet minimum balance requirements. Always check with your bank to understand any potential fees associated with depositing or cashing checks.

Fraud Prevention Measures

Banks have systems in place to detect and prevent fraudulent activity. Make sure that when you write a check to yourself, you clearly indicate the purpose and avoid any actions that might look suspicious.

Hold Times

Banks often place holds on checks to ensure they clear before making the funds available. Be aware of your bank’s policies and plan accordingly if you need the funds by a certain time.

Alternatives to Depositing a Personal Check to Yourself

If you’re looking to move money between accounts, there might be easier or more cost-effective methods than writing a check to yourself:

- Online Transfers: Many banks offer online transfers between accounts, which can be a quicker and more convenient option.

- Peer-to-Peer Payment Services: Services like PayPal or Venmo can be used to transfer funds, though they may not be ideal for larger amounts.

- Wire Transfers: For larger sums or more immediate transfers, a wire transfer might be appropriate, though this method often comes with fees.

Conclusion

Depositing a personal check to yourself is a perfectly legitimate and sometimes necessary part of managing your personal checkings. Whether you’re moving funds between accounts or simply prefer the paper trail associated with checks, it’s an option available to you. Always ensure you’re aware of any potential fees and hold times associated with check deposits and consider alternative methods for transferring funds that might be more convenient or cost-effective. With careful consideration and understanding of your personal checkings, you can manage your finances smoothly and efficiently.